Introduction to Cryptocurrency Trading

Cryptocurrency trading has rapidly evolved over the past decade, becoming a pivotal component of the global financial landscape. With the rise of digital currencies like Bitcoin, Ethereum, and thousands of altcoins, the trading practices surrounding these assets have garnered significant interest from both investors and the general public. As traditional financial systems increasingly integrate with emerging digital technologies, understanding the dynamics of cryptocurrency trading is more relevant than ever.

Current Trends in the Cryptocurrency Market

The cryptocurrency market has seen dramatic fluctuations, creating both opportunities and risks for traders. As of October 2023, the total market capitalisation of cryptocurrencies stands at approximately $1.15 trillion, with Bitcoin leading the charge, contributing around 45% of the overall market share. Furthermore, the emergence of decentralised finance (DeFi) and non-fungible tokens (NFTs) has transformed trading strategies, encouraging innovation in how assets are valued and exchanged.

Recent regulatory changes across various countries have also had a significant impact on cryptocurrency trading. The US Securities and Exchange Commission (SEC) has ramped up its scrutiny on cryptocurrency exchanges, aiming to provide clearer guidelines for both traders and platforms. Meanwhile, countries like El Salvador have embraced Bitcoin as legal tender, sparking debate around its impact on national economies.

Technological Advancements in Trading

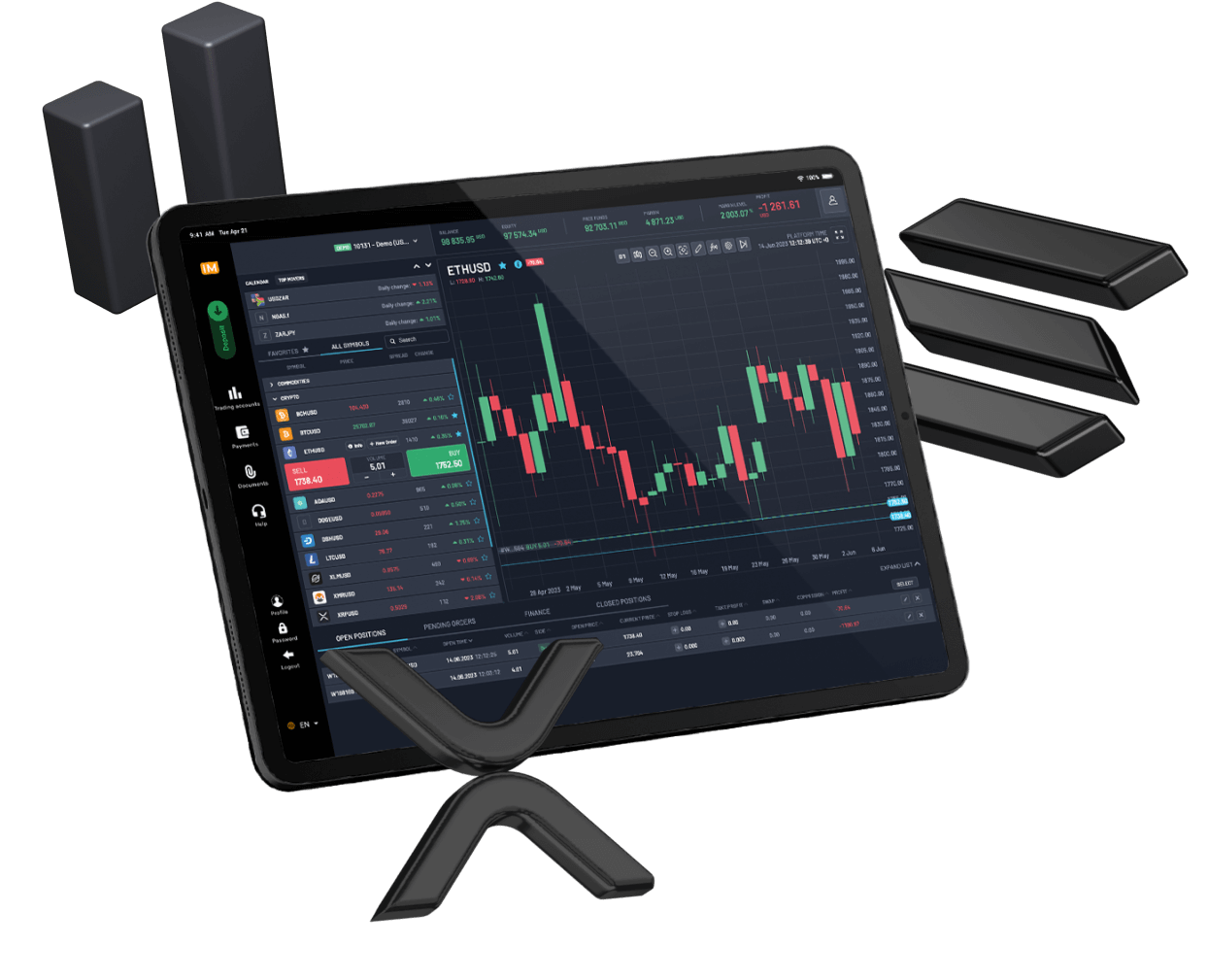

The rise of advanced trading platforms and tools has made cryptocurrency trading more accessible. Platforms like Binance, Coinbase, and Kraken now offer user-friendly interfaces alongside advanced features such as algorithmic trading options and market analytics. Moreover, the introduction of blockchain technology has increased transparency and security in transactions, reducing fraud and building trust among traders.

Conclusion: The Future of Cryptocurrency Trading

As we look to the future, cryptocurrency trading is poised to continue its upward trajectory, driven by technological advancements and increasing adoption by mainstream businesses and investors. However, potential traders must remain vigilant, informed about market trends, and compliant with regulatory frameworks. The ongoing developments suggest that cryptocurrency trading could redefine investment strategies and financial norms in the coming years, making it imperative for individuals to understand its intricacies and stay abreast of its evolution.