Introduction to Cryptocurrency Trading

Cryptocurrency trading has emerged as a prominent financial activity in recent years, attracting both seasoned investors and newcomers alike. As digital currencies continue to gain traction, understanding their trading dynamics becomes crucial for those looking to navigate this volatile market. With the rise of decentralised finance and increased adoption of digital assets, staying informed about cryptocurrency trading is more important than ever.

Current Trends in Cryptocurrency Trading

As of late 2023, cryptocurrency trading is witnessing significant shifts driven by regulatory changes and technological advancements. The implementation of clearer regulatory frameworks in various countries, including the US and European Union, is fostering a more secure trading environment. This has led to a surge in institutional investment, with major financial institutions actively trading cryptocurrencies or offering related services.

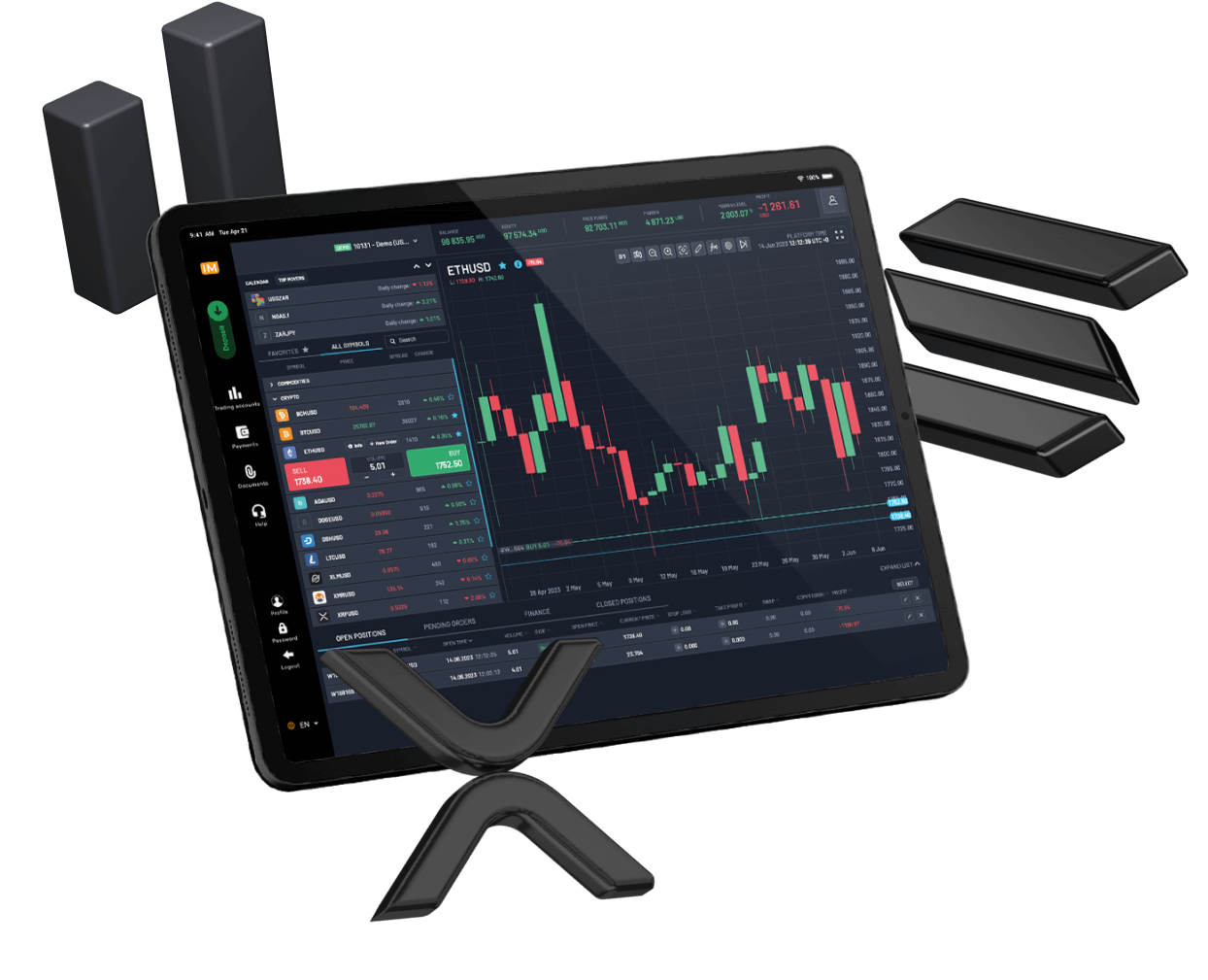

Furthermore, the development of trading platforms has enhanced accessibility for retail investors. Advanced trading interfaces, mobile applications, and the integration of artificial intelligence in trading bots are empowering users to engage in cryptocurrency trading efficiently. Decentralised exchanges (DEX) have also gained popularity, allowing users to trade directly from their wallets, thus minimising counterparty risks.

The Impact of Market Volatility

Although the cryptocurrency market offers ample opportunities for profit, it is also characterised by high volatility. Price swings can be substantial, often influenced by market sentiment, regulatory news, or technological breakthroughs. For instance, the recent approval of exchange-traded funds (ETFs) linked to Bitcoin has sparked significant trading activity, showcasing how news can impact market dynamics.

Traders must remain vigilant, employing risk management strategies to navigate these fluctuations. Tools such as stop-loss orders and diversification of assets are essential for safeguarding against potential losses during market downturns.

Conclusion and Future Outlook

As cryptocurrency trading evolves, it remains essential for participants to stay informed about market trends, regulatory developments, and emerging technologies. The continuing integration of cryptocurrencies into traditional financial systems suggests a promising future for trading in this sector. With an estimated market capitalisation expected to exceed trillions of dollars, the significance of cryptocurrency trading is undeniable. Investors who adopt a strategic approach to trading can pave the way for potential financial growth, despite the inherent risks involved.