Introduction to Bitcoin USD

Bitcoin, the first cryptocurrency created by Satoshi Nakamoto in 2009, has transformed the landscape of global finance. Its valuation against the US dollar (USD) serves as a critical barometer in understanding its adoption and market dynamics. As financial institutions and retail investors engage with Bitcoin, understanding its valuation against the USD has never been more relevant.

Current Trends in Bitcoin USD

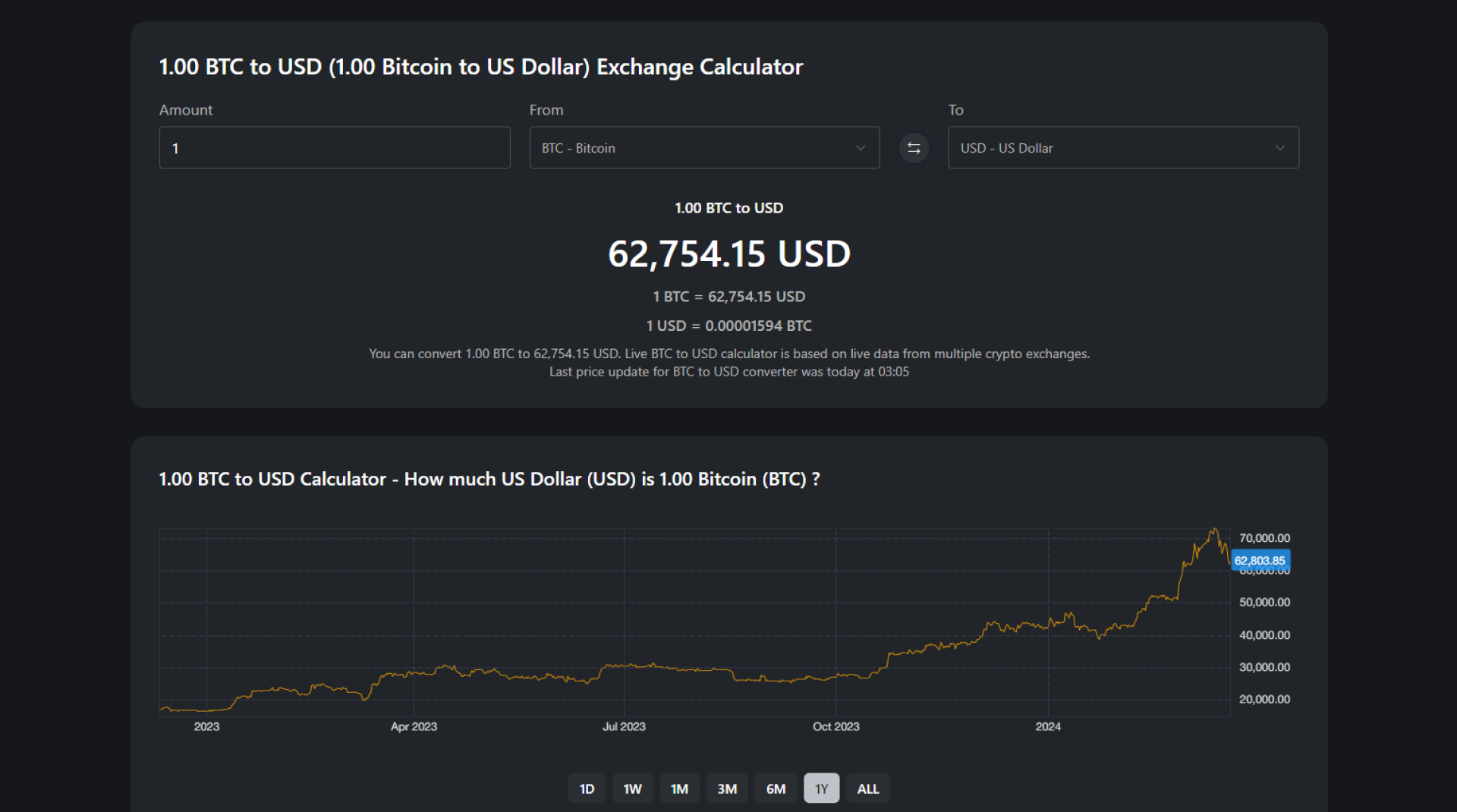

As of November 2023, Bitcoin is trading around $32,000 USD, showing significant volatility. In the past month, it has oscillated between $28,000 and $34,000, largely influenced by macroeconomic factors such as inflation rates, interest rate adjustments by the Federal Reserve, and overall investor sentiment towards risk assets. Recent reports indicate an uptick in institutional investments in Bitcoin, with firms diversifying their portfolios to include digital assets, contributing to its price movements.

Market Events Impacting Bitcoin USD

Several key events have recently impacted the value of Bitcoin against the USD. One notable event was the approval of a Bitcoin ETF (Exchange-Traded Fund) by the SEC, which has fueled optimism among investors and led to a surge in trading volume. Furthermore, growing conversations around regulatory clarity in the cryptocurrency market have provided a safer environment for investors, which in turn stabilises Bitcoin’s valuation.

Future Outlook for Bitcoin USD

Looking ahead, analysts predict that Bitcoin could potentially reach new highs, especially if macroeconomic conditions improve and inflation concerns subside. The potential for further regulatory support from governments globally may also positively influence its standing. However, experts caution that the cryptocurrency market remains speculative and that investors should remain vigilant regarding potential downturns.

Conclusion

The relationship between Bitcoin and the USD is more than just a currency conversion; it represents a broader shift in financial paradigms. For investors, understanding Bitcoin’s price dynamics against the USD is paramount in navigating the complexities of this digital asset. As we move forward into 2024, the performance of Bitcoin will continue to be informed by economic indicators, regulatory developments, and innovations within the blockchain space, making it a topic of interest for both seasoned investors and newcomers alike.