Introduction

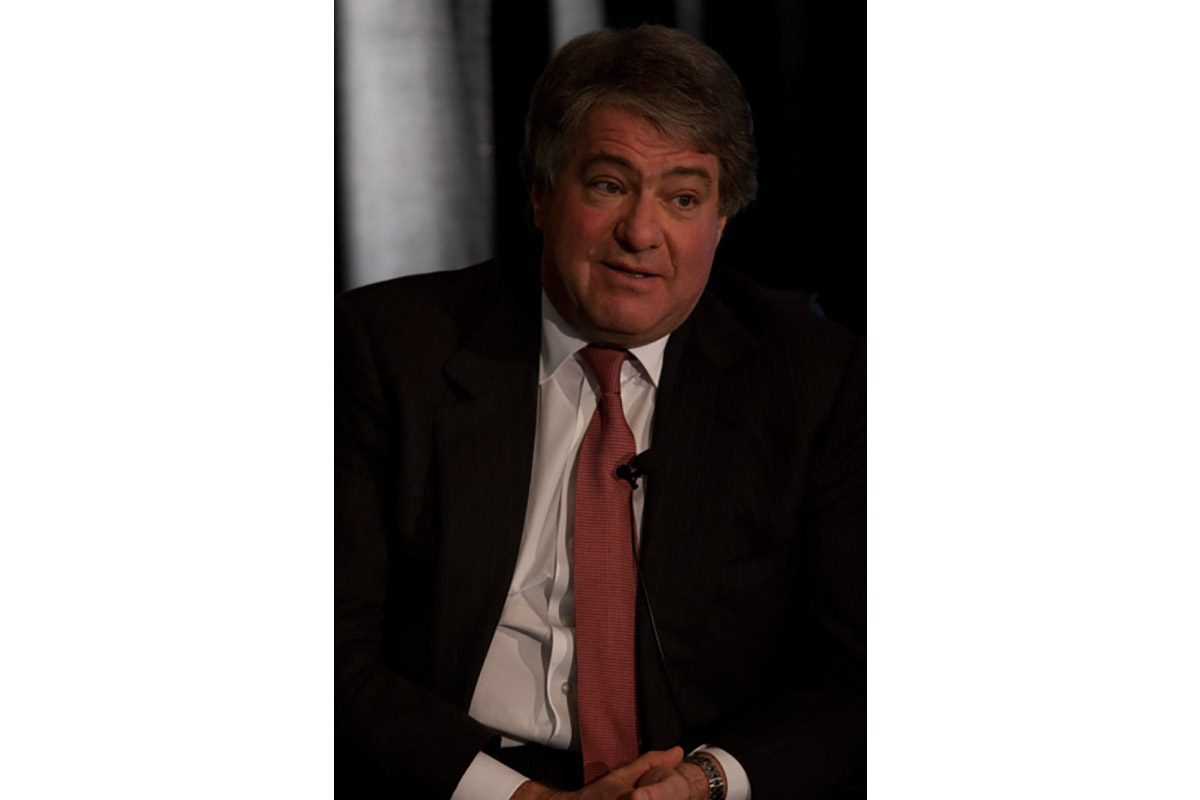

Leon Black, an influential figure in the world of finance, is known for his pivotal role in private equity and wealth management. His career has seen both significant successes and controversies, making him a relevant topic of discussion today. As the founder of Apollo Global Management, Black shaped the landscape of private equity and investment, and his impact resonates throughout the financial sector.

Black’s Career in Finance

Born on July 13, 1951, in New York City, Leon Black graduated from Harvard College and later earned an MBA from the Wharton School at the University of Pennsylvania. He began his career at Drexel Burnham Lambert, where he rose to prominence in high-yield debt finance. In 1990, he co-founded Apollo Global Management, which has grown into one of the largest alternative investment firms globally, with over $455 billion in assets under management as of 2023.

Successes in Private Equity

Under Black’s leadership, Apollo has acquired several high-profile companies across various industries. The firm’s strategy often involves turning around struggling businesses, enabling them to thrive under new management and operational strategies. Notable acquisitions include the purchase of ClubCorp and Caesars Entertainment, exemplifying Apollo’s ability to transform companies and drive significant returns.

Controversies and Challenges

Despite his successes, Leon Black’s reputation has faced scrutiny, particularly regarding his association with convicted sex offender Jeffrey Epstein. In early 2021, Black stepped down as CEO amid allegations of ties to Epstein, raising questions about ethical considerations in business partnerships. This scandal has had implications not only for Black’s personal brand but also for Apollo Global Management’s public image and future operations.

Philanthropy and Public Influence

Beyond finance, Black is known for his philanthropic efforts, particularly in the arts and education sectors. As the chairman of the Museum of Modern Art (MoMA) and a board member of several cultural institutions, he has committed millions to support the arts and foster creativity. His philanthropic legacy serves to balance the criticism he faces in the financial world.

Conclusion

Leon Black remains a significant figure in finance, and his journey illustrates the complexities of success in the investment world. As Apollo Global Management navigates the aftermath of recent controversies, the firm’s future direction will be closely watched by investors and analysts alike. The significance of Black’s leadership and decisions will continue to influence both his legacy and the broader financial landscape as we move forward into the coming years.