Introduction

The stock market serves as a vital barometer for economic health and investor sentiment. On October 3, 2023, key developments in stock markets around the globe captured the attention of investors and analysts alike. Understanding these movements is crucial for making informed trading decisions and assessing broader market trends.

Stock Market Overview

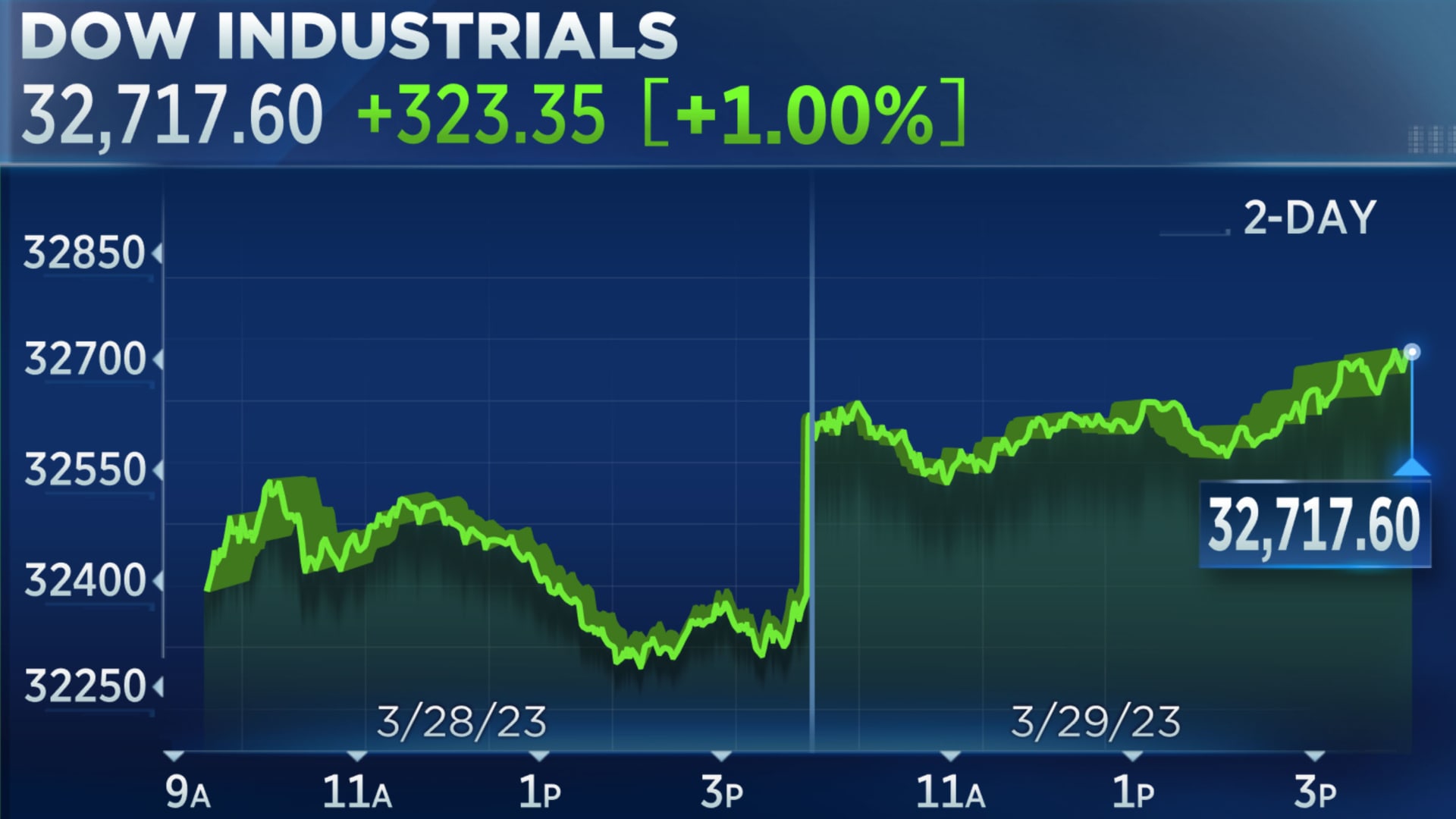

As of today, the benchmark indices in the United States displayed mixed performances. The S&P 500 has seen a modest rise of 0.3%, driven primarily by gains in the technology sector. Notable companies such as Apple and Microsoft reported better-than-expected sales forecasts, bolstering investor confidence. Alternatively, the Dow Jones Industrial Average reported a slight decline of 0.2% as concerns over inflation pressures weighed on some blue-chip stocks.

Global Market Trends

Internationally, European markets followed a similar trend, with the DAX in Germany and the FTSE 100 in the UK both experiencing slight increases. The European Central Bank’s recent comments on interest rates have influenced these movements, leading investors to anticipate a potential pause in rate hikes. In Asia, Japan’s Nikkei Index closed higher, buoyed by strong performance in manufacturing exports, indicating resilience in the country’s economic recovery.

Sector Highlights

The technology and healthcare sectors were prominent today, with technology stocks leading the gains. The resurgence in demand for tech services amid a return to remote working arrangements has particularly favoured software companies. Conversely, the energy sector experienced a downturn as crude oil prices fell by 2% due to fluctuations in global supply, resulting in downward pressure on major oil companies.

Conclusion

Today’s stock market news reflects a complex tableau of economic signals—from tech sector resilience to ongoing inflation concerns. While some indices show positive momentum, others face headwinds that could shape future trading strategies. Investors should remain vigilant and continue to monitor these dynamics as the economic landscape evolves. The remainder of this week is expected to be volatile, with key employment data scheduled for release that could further impact market sentiments.