Introduction

The decision by Santander to close a number of its bank branches has raised concerns among customers and industry analysts alike. With the shift towards digital banking accelerating, traditional bank branches are facing unprecedented pressures. These closures are significant not only for the customers who rely on in-person services but also for the wider implications for local economies and employment.

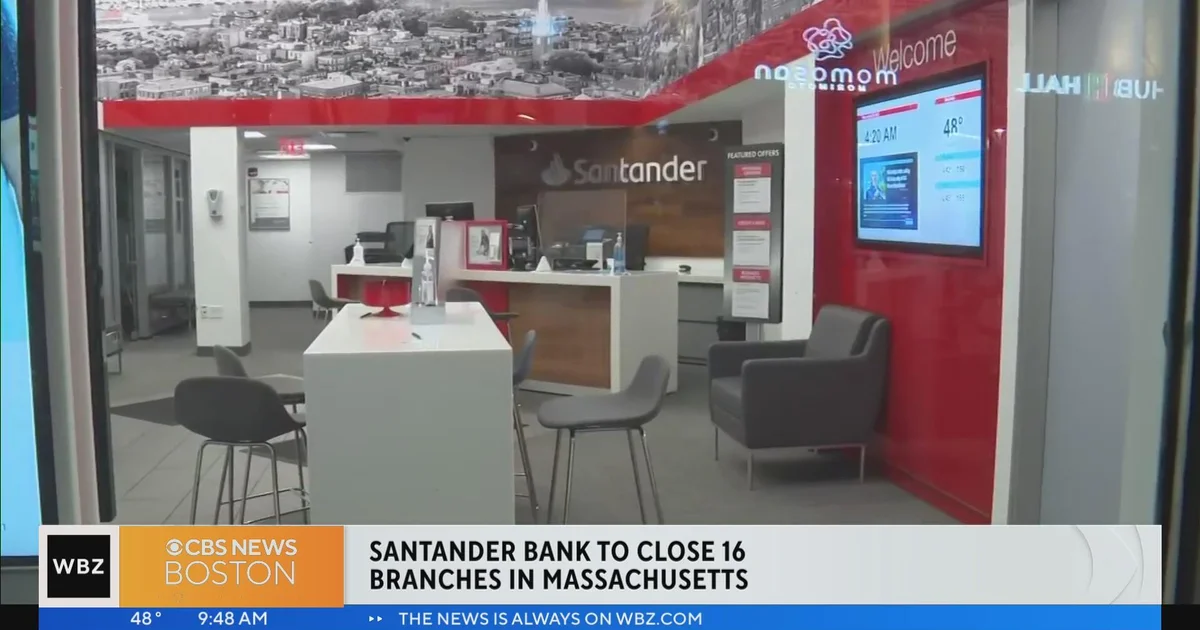

Details of the Closures

Recently, Santander announced plans to close 111 branches by the end of 2023, continuing a trend that has seen several high street banks reducing their physical presence. This move follows a broader industry pattern where digital banking adoption has surged post-pandemic, with more customers opting for online transactions rather than visiting branches.

The closure list includes branches in major cities and some smaller communities, which has led to criticism from consumer groups who argue that this decision disproportionately affects the elderly and those without internet access. According to Santander, the closures are part of a strategy to adapt to changing consumer habits while focusing on improving their digital services.

Customer Impact and Response

The response from customers has been mixed. Many have expressed frustration, highlighting a lack of access to essential banking services. Local communities are particularly concerned about the loss of personal banking relationships that can often lead to better financial advice and customer support.

In a statement, a Santander spokesperson mentioned, “This decision hasn’t been made lightly. We are committed to supporting our customers by investing in our digital platforms and ensuring those who need it can still access meaningful banking services in their communities.” Along with branch closures, Santander is increasing its investment in digital banking tools, which they believe will benefit the majority of their customers.

Conclusion

The trend of closing bank branches, as seen with Santander, indicates a significant shift in the banking landscape as institutions adapt to new technologies and customer preferences. While this may lead to increased efficiency and lower operational costs for banks, it simultaneously raises concerns about accessibility and the future role of physical banking in communities. As the landscape continues to evolve, it remains critical for banks to strike a balance between technology and personal service to ensure all customers have equal access to financial resources. Future forecasts suggest continuous branch closures unless counteracted by a strategy supporting in-person banking services alongside digital advancements.