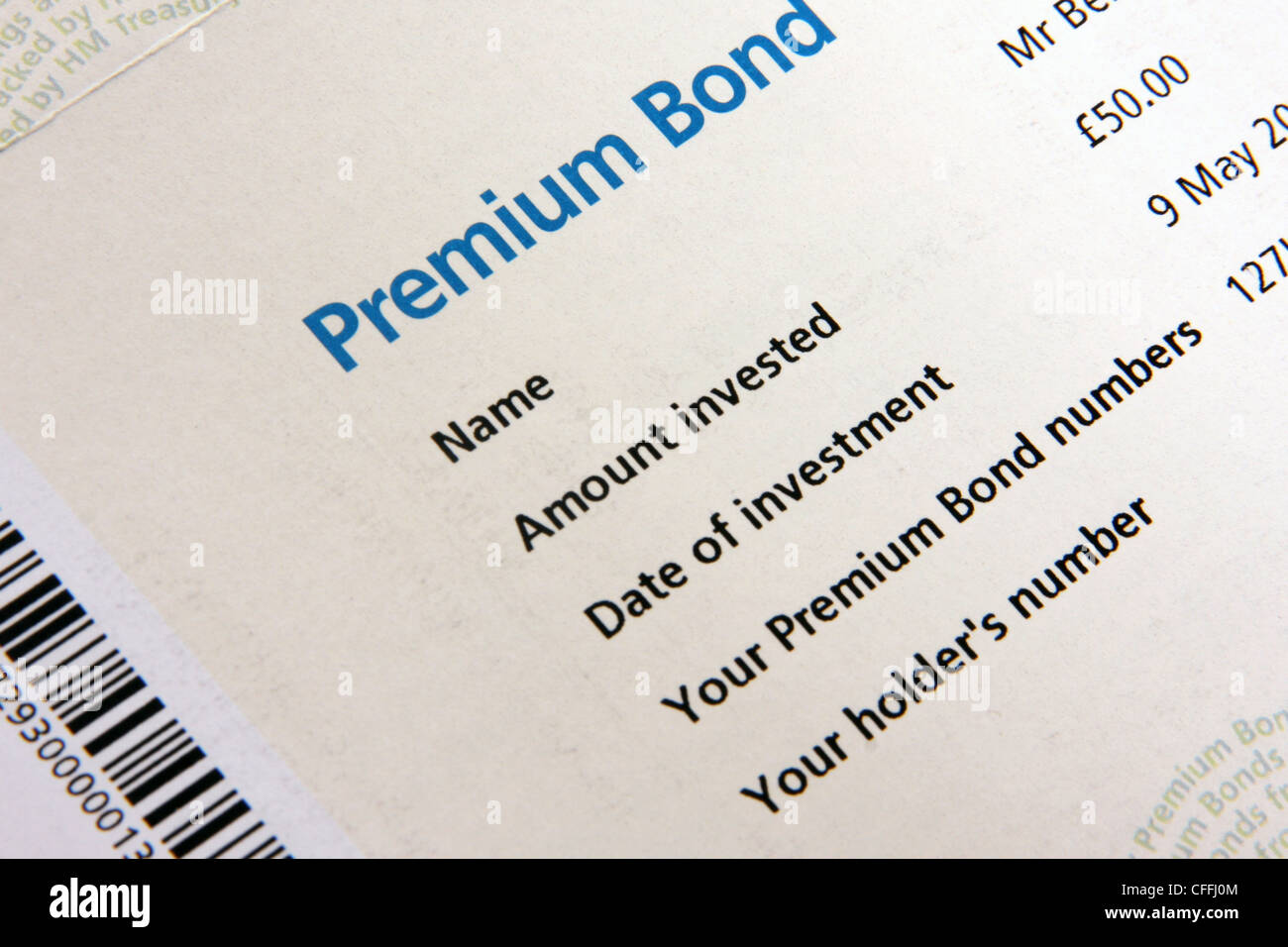

What Are Premium Bonds?

Premium bonds are a unique investment product offered by National Savings and Investments (NS&I) in the United Kingdom. They allow individuals to invest money while having the opportunity to win cash prizes instead of earning interest. Each bond purchased gives the holder a chance to enter a monthly prize draw, making these bonds a popular choice for risk-averse investors looking for a safe place to save.

How Do Premium Bonds Work?

When an investor buys premium bonds, their money is pooled with that of other bondholders, and a random number generator is used to select winning bonds each month. The minimum investment amount is £25, and there is no maximum limit, although the cap for an individual is currently set at £50,000. The prizes range from £25 to £1 million, with over 1.5 million prizes available each month.

The Appeal of Premium Bonds

One of the main attractions of premium bonds is that they are risk-free, as the capital is backed by the UK government. Investors can cash in their bonds at any time, receiving their full investment amount back. This flexibility, combined with the chance of winning substantial sums, makes premium bonds an appealing option, especially for savers looking to keep their money accessible.

Recent Trends and Developments

As of late 2023, premium bonds continue to see increased interest, particularly due to current low interest rates on traditional savings accounts. Many individuals are turning to premium bonds not only for the potential of winning but also as a safe haven for their savings. In recent months, there has been an uptick in monthly payouts, with the latest figures highlighting that approximately 1 in 24 bonds win a prize. This has further bolstered their appeal amid changing economic conditions.

Conclusion: The Future of Premium Bonds

Premium bonds have secured their place in the investment landscape of the UK. With growing numbers of participants and increasing rates of return on prizes, they offer a unique combination of safety and excitement for investors. As economic factors evolve, premium bonds may become an even more attractive option for those seeking to preserve capital while enjoying the thrill of potential winnings. For individuals considering their investment strategies, understanding premium bonds remains vital in the current financial climate.