Introduction

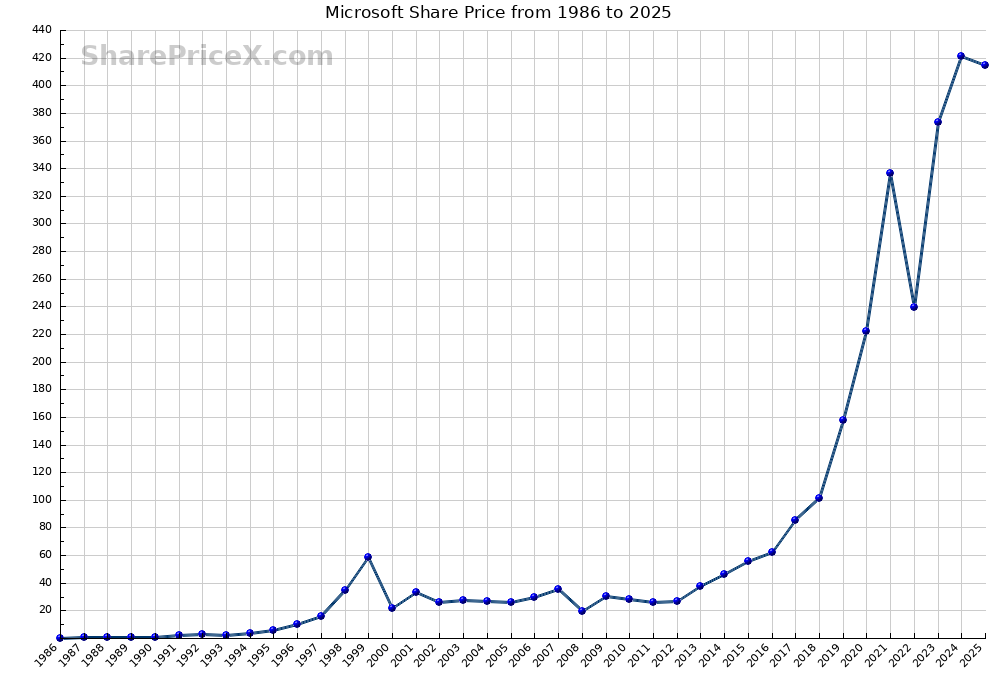

The share price of Microsoft Corporation, a leader in technology and software, has been a focal point for investors and analysts alike, especially considering the company’s recent performance in the stock market. Understanding the dynamics of Microsoft’s share price is crucial not only for investors but also for those keeping an eye on the ever-evolving tech industry.

Current Market Performance

As of October 2023, Microsoft’s share price has demonstrated notable resilience amidst various market challenges. Recent trading sessions show the stock hovering around £300 per share, having experienced fluctuations due to broader economic factors, including interest rate hikes and market volatility stemming from geopolitical tensions and inflationary pressures. Investors have reacted positively to Microsoft’s continued commitment to cloud computing, AI technologies, and strategic acquisitions.

Key Drivers of Share Price

1. **Cloud Computing Growth:** Microsoft Azure has seen exponential growth, significantly contributing to the company’s revenue. Analysts suggest that the ongoing shift to cloud services will continue to bolster Microsoft’s share price as companies around the globe transition to digital infrastructures.

2. **Artificial Intelligence Investments:** The company’s significant investments in AI technologies have positioned it as a frontrunner in the space. With the integration of AI across its product lines, from Office 365 to its Dynamics suite, Microsoft’s innovation is likely to attract more investors.

3. **Financial Stability:** Microsoft showcases a strong balance sheet, with healthy cash reserves allowing for continued investments and shareholder returns through dividends and share buybacks. This financial strength instils confidence among investors, thus influencing the share price positively.

Conclusion and Future Outlook

In conclusion, Microsoft’s share price reflects the company’s robust business model and positive market sentiment despite current economic uncertainties. Analysts generally forecast a steady increase in the share price as the company capitalises on growth opportunities in cloud computing and AI technologies. Investors are advised to consider the broader market trends while keeping a close watch on Microsoft’s strategic moves, as these will likely dictate future performance. Thus, staying informed about Microsoft’s developments and market dynamics remains crucial for potential and existing investors.