Introduction

Mortgage rates today are a crucial factor for potential homebuyers and property investors in the UK. As the housing market continues to evolve amidst economic changes, keeping an eye on mortgage rates is essential for making informed financial decisions. In recent weeks, fluctuations in interest rates have significantly impacted affordability and buyer sentiment, making it more important than ever to stay updated on the current rates.

Current Trends in Mortgage Rates

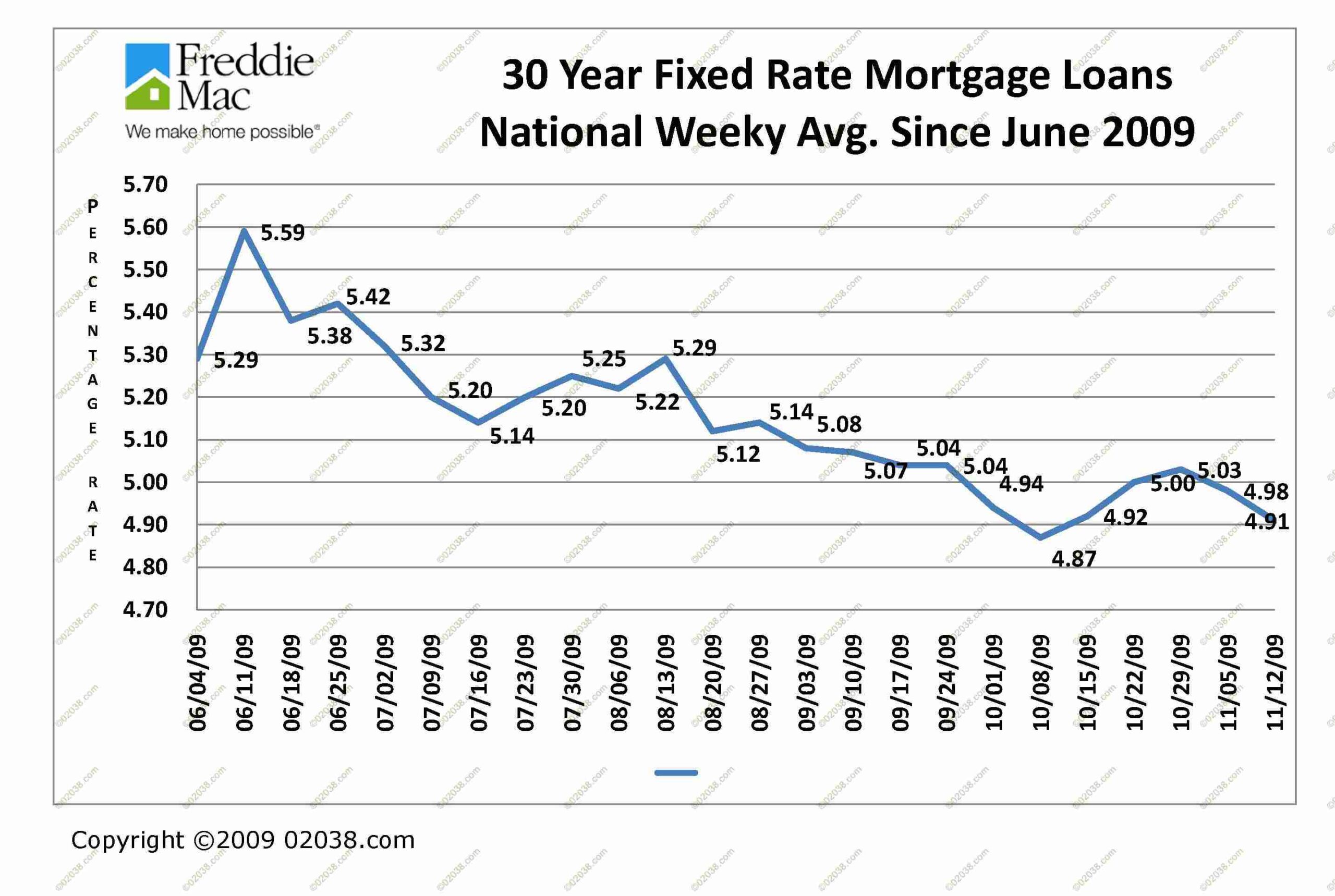

As of October 2023, average mortgage rates in the UK have seen both increases and decreases, influenced by both inflation and the Bank of England’s monetary policy. According to recent data from UK Finance, the average two-year fixed mortgage rate stands at approximately 5.3%, while the five-year fixed rate has settled around 5.1%. These rates represent an adjustment from earlier in the year when rates were considerably higher.

Market analysts attribute these changes to the Bank of England’s efforts to combat inflation, which has remained a persistent issue as the economy recovers post-pandemic. The central bank’s decisions on the base interest rate directly affect mortgage pricing, leading to fluctuations that homebuyers need to navigate carefully.

Impact on Homebuyers

The current mortgage rates have significant implications for homebuyers. Higher rates mean higher monthly payments, which can deter first-time buyers from entering the market. The National Association of Estate Agents has reported a decline in the number of new buyers registering with estate agents in light of rising borrowing costs.

On the other hand, those with fixed-rate mortgages secured in previous years may benefit, as they avoid the recent climbs in borrowing costs. However, homeowners coming to the end of their fixed terms face the challenge of refinancing at higher rates, which could result in increased financial strain.

Future Predictions

Experts suggest that mortgage rates are likely to remain volatile as economic conditions continue to evolve. High inflation rates and ongoing geopolitical tensions may keep rates elevated for the foreseeable future. Additionally, the Bank of England’s approach to interest rates will play a crucial role in shaping the mortgage landscape.

For potential homebuyers, staying informed and prepared is essential. Securing mortgage pre-approvals and consulting with financial advisors could provide advantages in an unpredictable market. Ultimately, understanding mortgage rates today and their implications will empower individuals to make well-informed decisions in their property financing journeys.

Conclusion

In summary, mortgage rates today have a profound impact on the housing market, affecting buyer behaviour and financial planning. With current averages hovering around 5.3% for two-year fixed and 5.1% for five-year fixed mortgages, potential homebuyers must navigate a challenging landscape. As rates evolve, ongoing education and proactive financial strategies will help individuals position themselves effectively in a competitive market.