Introduction to Lifetime ISAs

The Lifetime Individual Savings Account (ISA) is a crucial financial tool designed to assist UK’s citizens in saving for their first home and for retirement. Launched in 2017, it allows individuals aged 18 to 39 to save up to £4,000 each tax year, benefiting from a government bonus of 25% on their contributions. This scheme aims to encourage savings while making housing more accessible for younger generations.

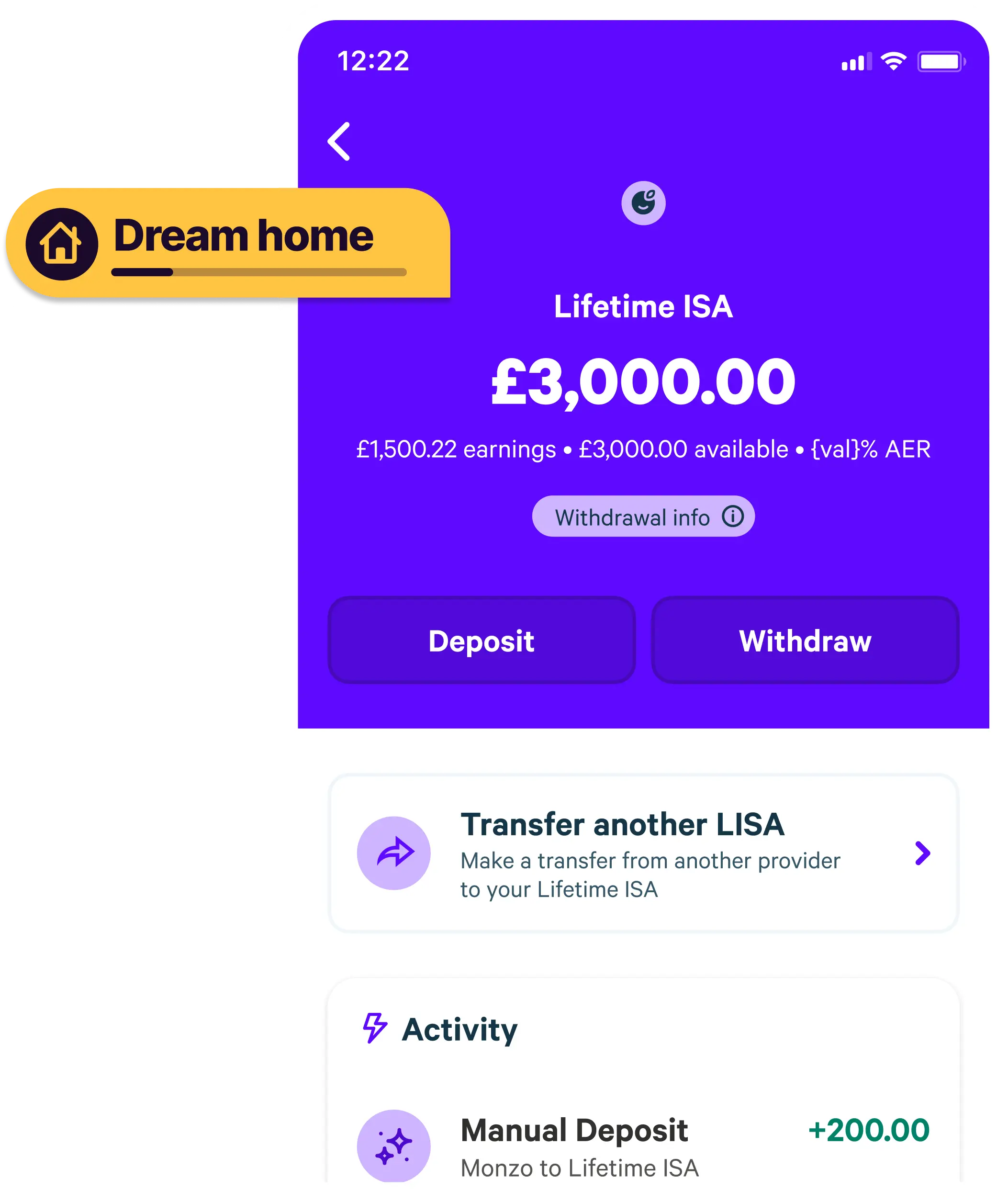

The Benefits of a Lifetime ISA

One of the most attractive features of the Lifetime ISA is the government bonus, which can amount to as much as £1,000 per year if the full £4,000 is saved. This means that young savers can accumulate a significant amount towards a deposit for their first home. Additionally, funds can be used for retirement savings, allowing individuals to withdraw the money tax-free after the age of 60. This dual-purpose functionality makes the Lifetime ISA a versatile financial product.

How Does It Work?

To open a Lifetime ISA, individuals must be at least 18 and under 40. The annual contribution limit is £4,000, and any money saved within the account grows tax-free. When purchasing a first home, the saved amount along with the government bonus can be used towards the deposit. It’s important to note that the funds must be used to buy a property worth up to £450,000 and must be held in the ISA for at least 12 months before withdrawal.

Recent Developments and Challenges

As of 2023, there have been discussions in Parliament regarding reforming the Lifetime ISA rules to enhance its effectiveness. Currently, some critics argue that the withdrawal penalties for non-first-time buyers are overly harsh. There is also a growing call for raising the contribution limit to keep pace with rising property prices, ensuring that the Lifetime ISA remains a viable option for potential homeowners.

Conclusion and Future Outlook

The Lifetime ISA presents a beneficial savings option for younger individuals looking to set themselves up for the future. With the ability to use it for both home purchases and retirement, it addresses two major financial milestones. As the government considers how to adapt the product to changing economic conditions, savers should remain informed about potential updates. The Lifetime ISA continues to be an essential consideration for first-time buyers and those planning for retirement, making it a relevant and significant financial instrument in the UK.