Introduction to Unilever’s Share Performance

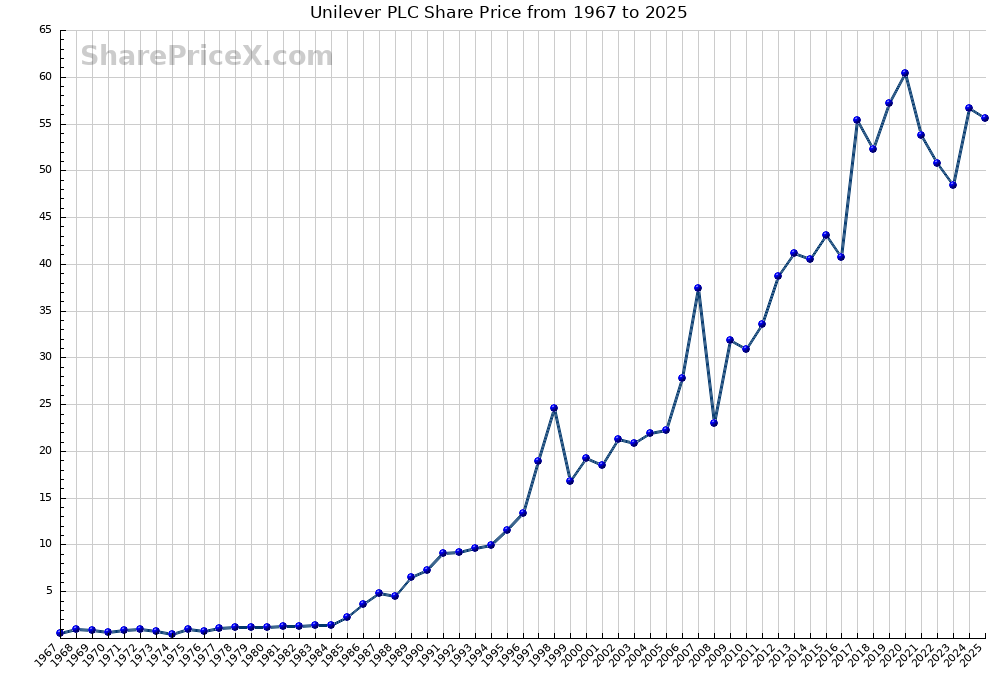

The Unilever share price is an important indicator of the performance of one of the world’s largest consumer goods companies. As a multinational corporation that operates in over 190 countries, fluctuations in its share price can have significant implications for investors and markets alike. The importance of tracking the Unilever share price lies not only in its reflection of the company’s operational success but also in its relevance to economic trends and consumer behaviour.

Current Trends in Unilever Share Price

As of October 2023, Unilever’s share price has exhibited volatility, reflecting the broader economic factors and consumer confidence levels. Recent reports indicate a slight dip in the share price, attributed to rising input costs and adjustments in consumer spending patterns in response to inflationary pressures. Data from Financial Times shows that Unilever’s share price has recently traded around £40 per share, representing a notable decrease compared to the previous year.

Factors Influencing the Share Price

Several critical factors contribute to the movement of Unilever’s share price. Firstly, global commodity prices have surged due to supply chain disruptions, which impacts production costs. Furthermore, financial analyst reports highlight that consumer purchasing patterns are shifting, with an increasing focus on value for money, thereby affecting revenue expectations. Additionally, Unilever’s strategic decisions, including recent acquisitions aimed at expanding its portfolio in the beauty and wellness sectors, also play a role in investor sentiment.

Outlook and Significance for Investors

Looking ahead, analysts suggest that Unilever’s share price may stabilise as the company adapts to changing market conditions and enhances its operational efficiencies. The ongoing commitment to sustainability through green initiatives and an emphasis on digital transformation are expected to bolster consumer trust and, subsequently, investor confidence in the long term. For potential investors, understanding the underlying factors affecting the Unilever share price can facilitate informed decision-making and portfolio management.

Conclusion

In conclusion, the Unilever share price is not just a number; it is a barometer of the company’s overall health amidst fluctuating market conditions. Keeping abreast of the trends and influences surrounding this share price is crucial for any investor considering engagement with Unilever. As economic conditions evolve, the company’s proactive strategies may pave the way for recovery and growth, offering potential investment opportunities moving forward.