Introduction to Cryptocurrency Trading

In recent years, cryptocurrency trading has surged in popularity, becoming a pivotal aspect of modern finance. As digital currencies like Bitcoin and Ethereum gain traction, understanding the dynamics of cryptocurrency trading is essential for investors and enthusiasts alike. With an estimated global market capitalization exceeding $2 trillion, the relevance of cryptocurrency trading cannot be understated.

Current Trends in Cryptocurrency Trading

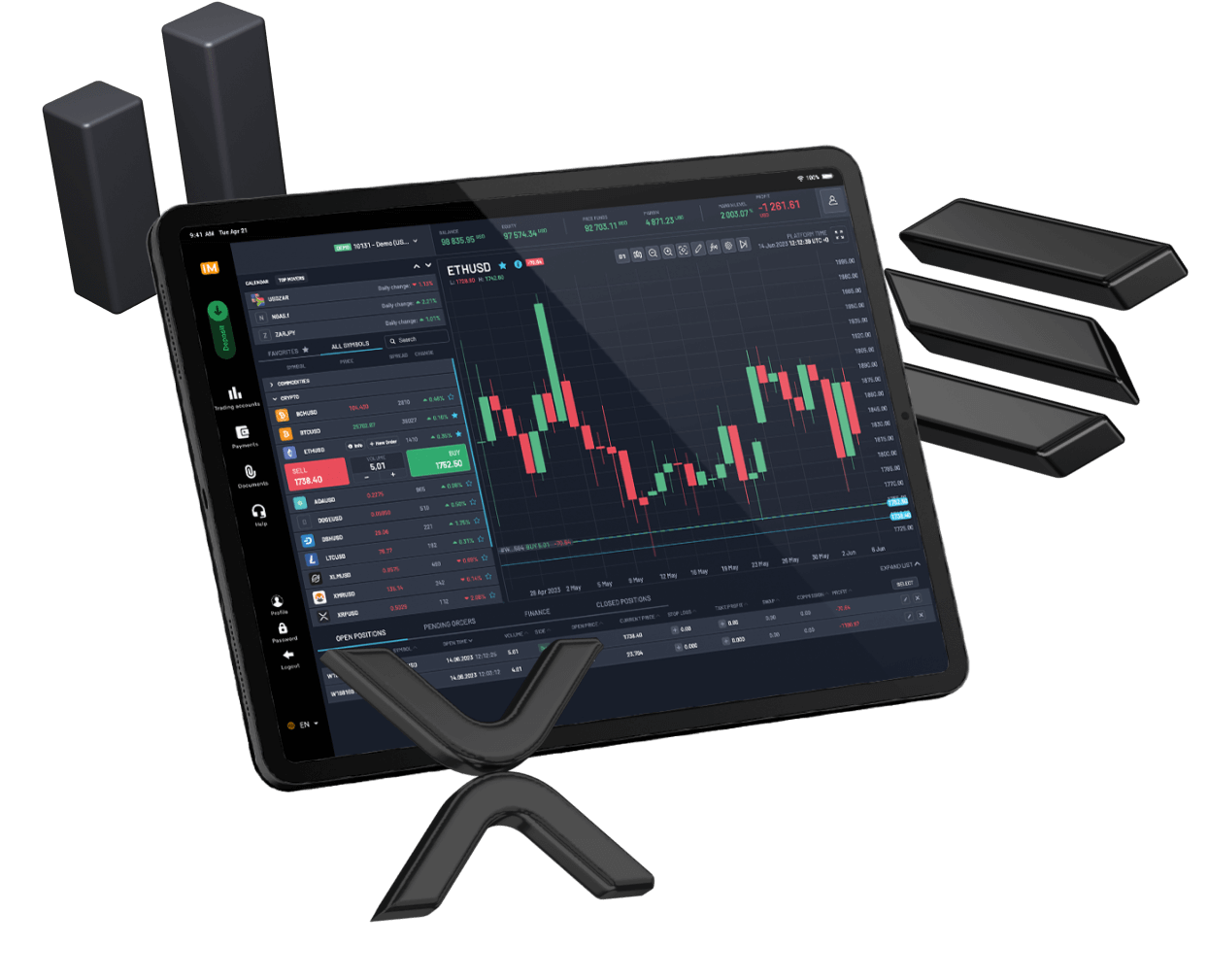

As of 2023, cryptocurrency trading platforms have observed a monumental increase in user engagement, driven by the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs). Major exchanges, such as Binance and Coinbase, report record transaction volumes, signifying growing interest among both retail and institutional investors. Trading strategies have also evolved, with algorithmic trading gaining popularity due to its potential to capitalize on market volatility.

Challenges and Risks

Despite the potential rewards, cryptocurrency trading is not without its challenges. Regulatory scrutiny is heightened in many regions, creating uncertain trading environments. In addition, the market remains notoriously volatile, with price swings that can lead to significant losses. November 2023 saw a temporary market dip triggered by potential regulatory changes in the United States, reminding traders of the need for vigilance and risk management.

The Future of Cryptocurrency Trading

Looking ahead, the future of cryptocurrency trading appears poised for continued evolution. As traditional financial institutions increasingly embrace digital currencies, participants can anticipate enhanced market integration. Additionally, the introduction of Central Bank Digital Currencies (CBDCs) may reshape trading dynamics. Predictions for 2024 suggest a further expansion of retail participation, and increased interest in exchange-traded funds (ETFs) based on cryptocurrencies.

Conclusion

In summary, cryptocurrency trading stands at the forefront of financial innovation, offering opportunities and challenges alike. Understanding market trends, potential regulatory factors, and the importance of prudent risk management is crucial for anyone considering entering this dynamic market. As the landscape continues to evolve, keeping informed will empower traders and investors to navigate the complexities of cryptocurrency trading effectively.