Introduction

The share price of NatWest Group plc, a leading bank in the UK, serves as a key indicator of its financial health and market performance. As investors keep a close eye on the performance of financial stocks, understanding the dynamics of NatWest’s share price is vital for both shareholders and potential investors. With the changing economic landscape, including interest rates and inflation, it is crucial to analyse how these factors impact the stock’s performance.

Current Performance

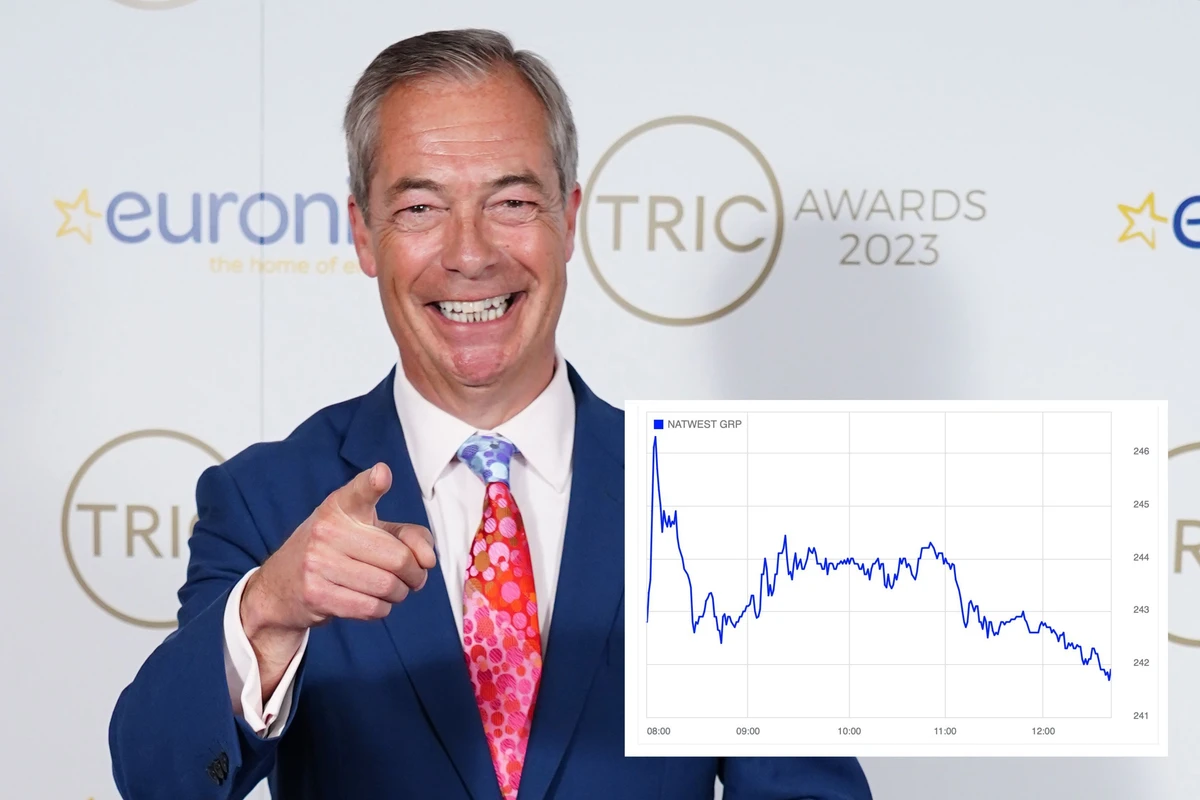

As of mid-October 2023, NatWest share price has seen fluctuations in response to the broader economic conditions and specific company developments. Shares were trading around £3.45, representing an increase of approximately 5% over the past month. This upward momentum comes after a series of positive financial results reported during the last quarterly earnings call, wherein NatWest reported a net income of £1.9 billion, driven by robust lending and efficient operational management.

Market Influence Factors

Several factors have influenced NatWest’s share price recently. Interest rates are a significant driver; as the Bank of England maintains a cautious approach to rate hikes, NatWest stands to benefit from improved lending margins. Moreover, the bite of inflation also plays into consumer borrowing behaviour; however, inflationary pressures are impacting costs across the banking sector.

Additionally, the Bank’s strategic efforts to enhance its digital banking services appeal to a younger demographic, potentially increasing the customer base and in turn affecting the share price positively.

Analyst Perspectives

Market analysts have differing perspectives on the NatWest share price. Some bullish analysts predict an extended upward trajectory for the shares based on steady growth in retail banking and the projected decline in loan defaults. Conversely, bearish analysts caution that prolonged economic uncertainty and potential regulatory challenges could pose risks to the bank’s profitability.

Conclusion

In summary, NatWest’s share price remains subject to various influences, including macroeconomic conditions and internal corporate strategy. For investors, staying informed about market trends and company performance is paramount in making judicious decisions regarding their portfolios. As we approach the end of 2023, it will be interesting to observe how NatWest navigates these challenges and opportunities, and whether its share price reflects continued robust performance or faces headwinds.