The Significance of Cryptocurrency Trading

Cryptocurrency trading has surged in popularity over the past few years, becoming a pivotal sector in the financial market. With the rise of various digital currencies, such as Bitcoin, Ethereum, and newer altcoins, traders and investors are increasingly looking to capitalise on the significant price movements and innovations within this space.

Current Trends in Cryptocurrency Trading

As of October 2023, the cryptocurrency market is witnessing a notable recovery following the fluctuations caused by regulatory uncertainties earlier in the year. Bitcoin, the leading cryptocurrency, has regained momentum, hovering around the $50,000 mark, an increase of approximately 30% from its mid-year lows. This rebound can be attributed to a growing acceptance of cryptocurrencies among institutional investors, bolstered by developments in regulatory frameworks in key markets.

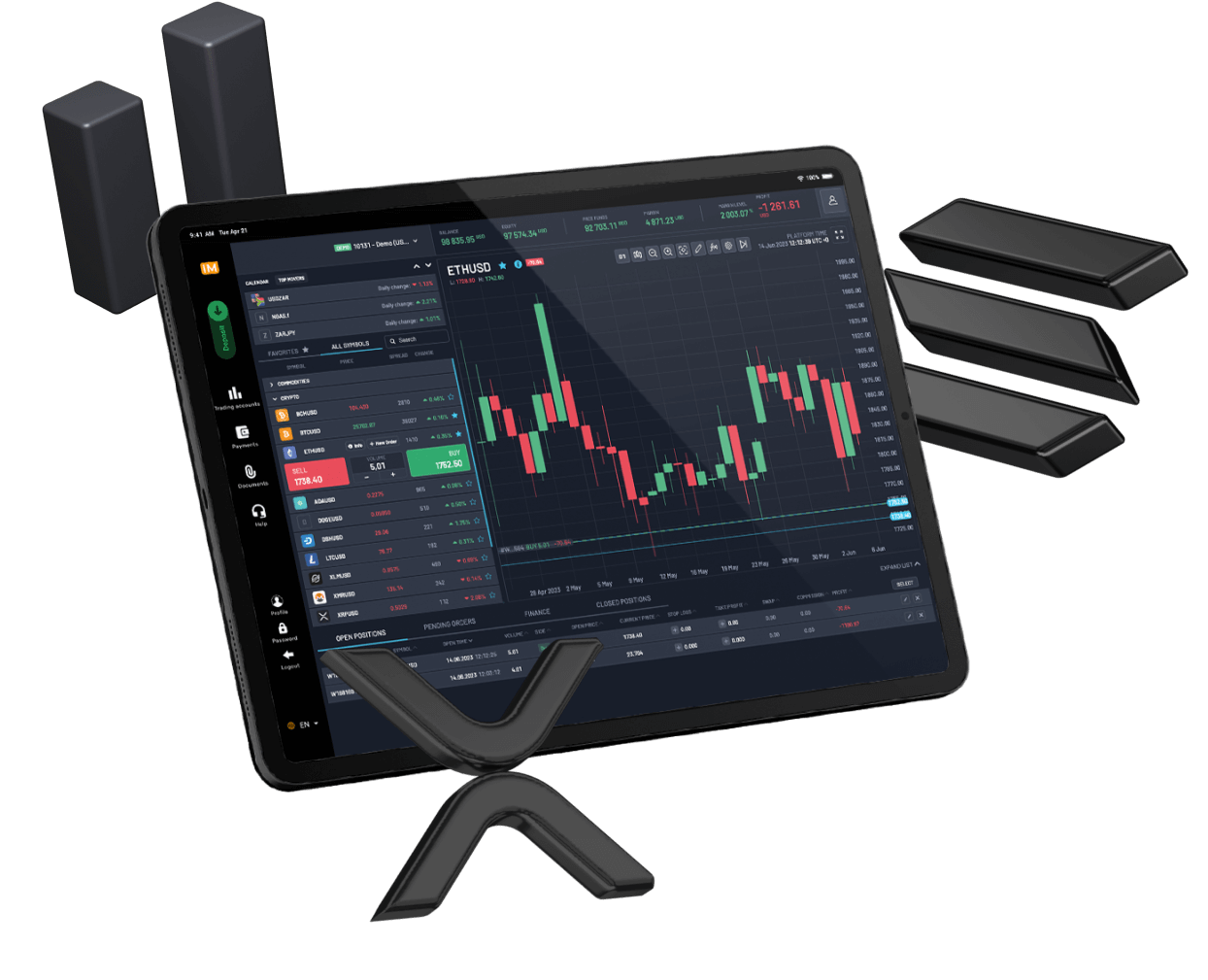

Another trend is the increasing integration of blockchain technology in various sectors, which enhances the credibility and utility of cryptocurrencies. Decentralised finance (DeFi) and non-fungible tokens (NFTs) continue to capture attention, encouraging retail participation in trading. Moreover, platforms facilitating automated trading through algorithms and bots are gaining traction, making trading more accessible.

The Risks and Opportunities

Despite the potential rewards, cryptocurrency trading is inherently risky. Market volatility remains a concern, with prices capable of extreme swings within short periods. Traders must remain vigilant and informed, considering factors such as market sentiment, technological advancements, and global economic conditions that can impact prices.

Security issues are another critical consideration, as instances of hacks and fraud persist within the industry. Popular exchanges have implemented enhanced security measures, yet investors must still exercise caution and consider using secure wallets for storing their assets.

Conclusion: The Future of Cryptocurrency Trading

Looking ahead, the future of cryptocurrency trading appears promising, yet unpredictable. As regulations mature and cryptocurrency becomes more mainstream, both retail and institutional interest is likely to grow. Investors and traders must stay informed and adapt to the rapidly evolving landscape, balancing the potential for reward with the inherent risks.

Ultimately, cryptocurrency trading represents not only a financial opportunity but also a revolutionary shift in how we perceive and interact with currency and financial systems. As the market stabilises and expands, it is crucial for participants to continuously educate themselves and remain prepared for the dynamics of this digital frontier.