Introduction

In today’s fast-paced economic landscape, understanding stock market news is essential for investors and traders alike. The stock market serves as a barometer for the overall health of the economy, reflecting investor sentiment and economic indicators. Recent developments have made news today particularly significant, as it impacts not only individual portfolios but also broader financial trends.

Key Updates from the Stock Market

As of today, the UK stock market has shown moderate fluctuations, with the FTSE 100 index experiencing a slight decrease of 0.5%. Analysts attribute this downtrend to ongoing concerns about inflation and interest rates, which continue to affect investor confidence. Additionally, the Bank of England’s latest report indicated that inflation is projected to remain above target for the foreseeable future, causing unease among market participants.

Sector performance varies starkly, with technology stocks witnessing a modest rally following the announcement of new government incentives aimed at encouraging innovation and investment in green technologies. Companies such as ARM Holdings have seen a rise in share prices, benefiting from positive growth forecasts. Conversely, the banking sector remains under pressure, largely due to increased scrutiny surrounding regulatory practices and consumer protection laws.

Global Influences

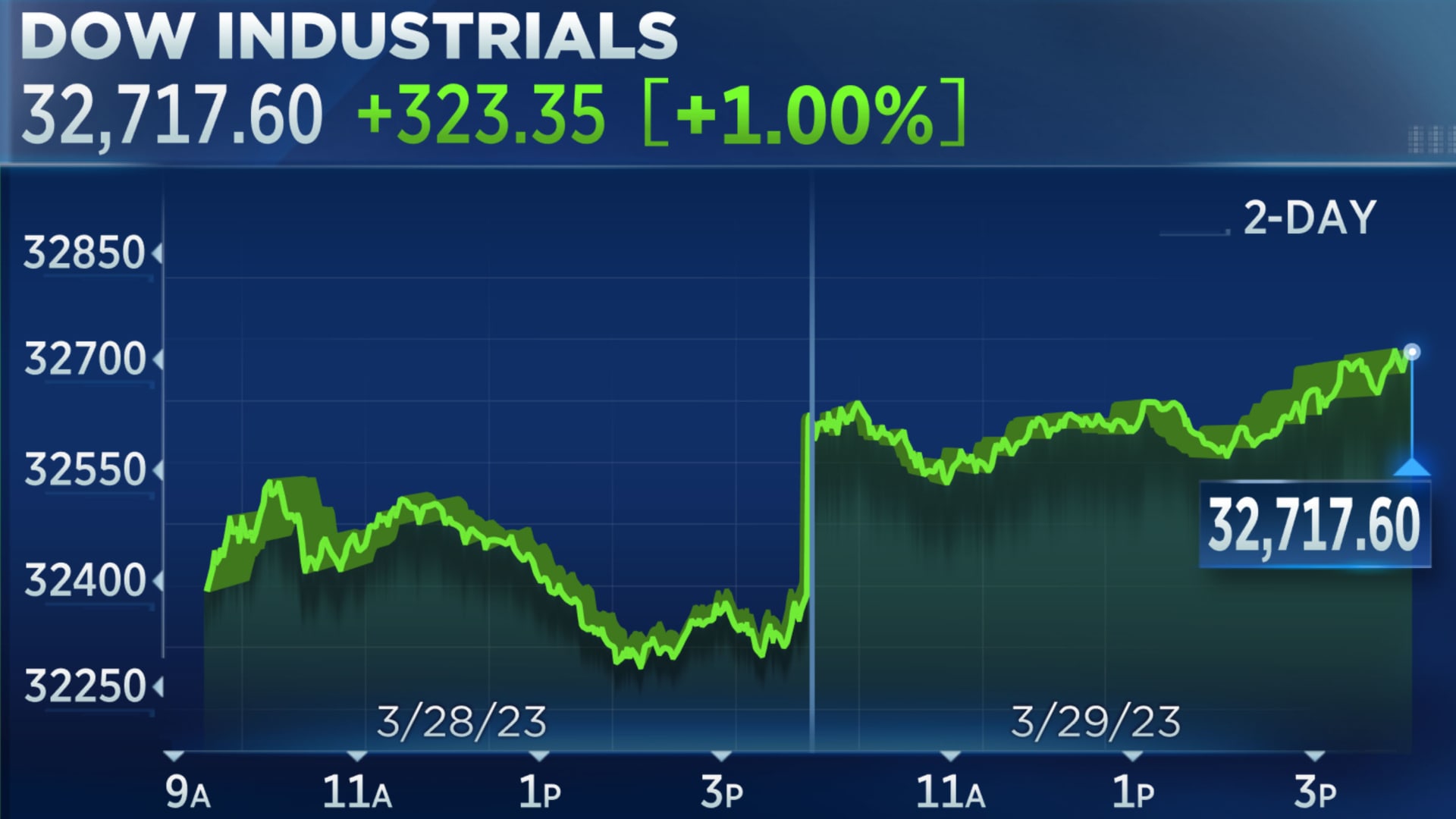

Internationally, stock markets are also grappling with uncertainties related to geopolitical tensions and supply chain disruptions stemming from ongoing conflicts in Eastern Europe and trade disputes involving major economies. As these global events unfold, investors are advised to remain vigilant and consider the ripple effects on the UK stock market. The US stock market, which had a notable drop yesterday, is impacting investor sentiment worldwide, instigating further caution among traders.

Conclusion and Outlook

As we move through the trading day, keeping an eye on stock market news is essential for making informed decisions. The current climate suggests that volatility may be a constant feature in the short term, driven by both domestic challenges and global events. Analysts predict that while short-term dips are likely, long-term investments in sectors poised for growth, such as technology and renewable energy, may offer attractive opportunities for investors.

In conclusion, today’s stock market news serves as a crucial reminder of the interconnectedness of global markets and the importance of agile investment strategies. Traders and investors are encouraged to stay informed and responsive to the rapidly changing economic environment.