Introduction

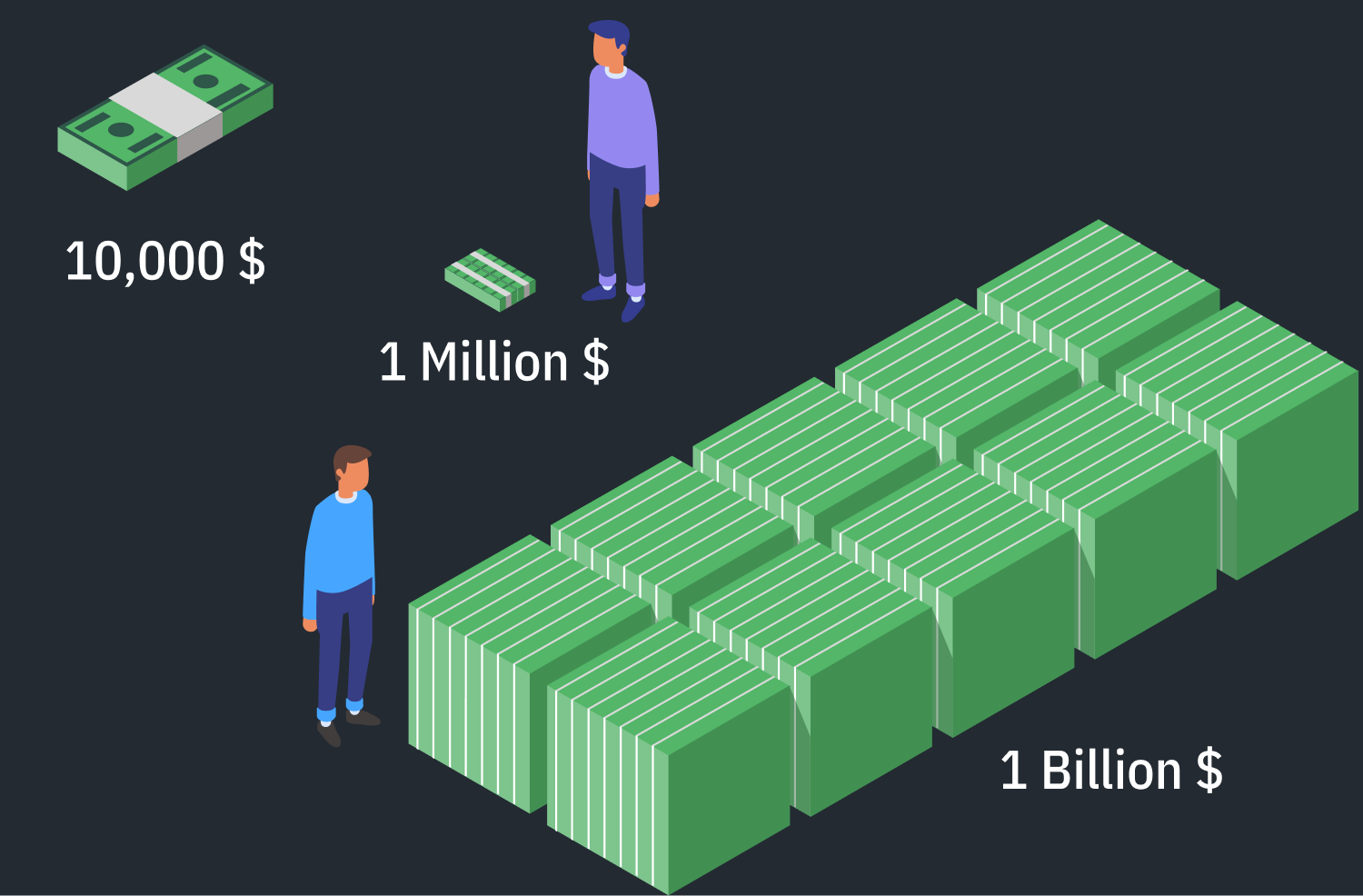

The concept of ‘billion’ has taken centre stage in today’s economic discourse, especially as the world’s wealth continues to reach unprecedented heights. This is particularly relevant in light of recent events where various industries are now reporting valuations exceeding the billion-dollar mark. Understanding this trend is crucial for grasping the dynamics of global financial systems.

Current Landscape

As of 2023, reports indicate that there are more than 2,700 billionaires worldwide, a testament to the stark wealth disparity present in global markets. The technology and healthcare sectors are at the forefront, exemplified by companies such as Tesla, which has been valued over $800 billion, and Moderna, whose vaccine development has propelled its market value to new heights. Additionally, the cryptocurrency market has also seen billion-dollar valuations, with Bitcoin and Ethereum paving the way.

Significant Events

Recent funding rounds and mergers have contributed to this trend, especially within the tech sector. For instance, several startups have recently announced funding exceeding a billion dollars, which not only highlights investor confidence but also reflects a competitive market eager for innovation. The increasing interest from venture capitalists in artificial intelligence (AI), renewable energy, and biotechnologies can be seen as driving this momentum.

Market Implications

The implications of billion-dollar valuations are far-reaching. Companies with such valuations are often viewed as market leaders and trend setters, influencing not just their specific sectors but the economy as a whole. Such success often translates to more job creation and advances in technology and research, ultimately benefiting society. However, it also raises questions about sustainability and the long-term viability of such rapid growth.

Conclusion

The prominence of billion-dollar companies reflects shifting economic landscapes shaped by innovation and market dynamics. As industries continue to evolve, it’s essential for investors and consumers alike to stay informed about these changes. The rise of billion-dollar valuations could lead to significant opportunities and challenges in the future, making it crucial to monitor this trend closely.