Introduction

The share price of NatWest Group Plc, one of the UK’s leading banking institutions, has garnered significant attention from investors in recent weeks. Understanding the dynamics behind the NatWest share price is crucial not only for shareholders but also for those interested in the broader financial market trends and the economic environment in the UK. With the current landscape shaped by rising interest rates and economic uncertainties, tracking the performance of NatWest shares has become increasingly pertinent.

Recent Trends in NatWest Share Price

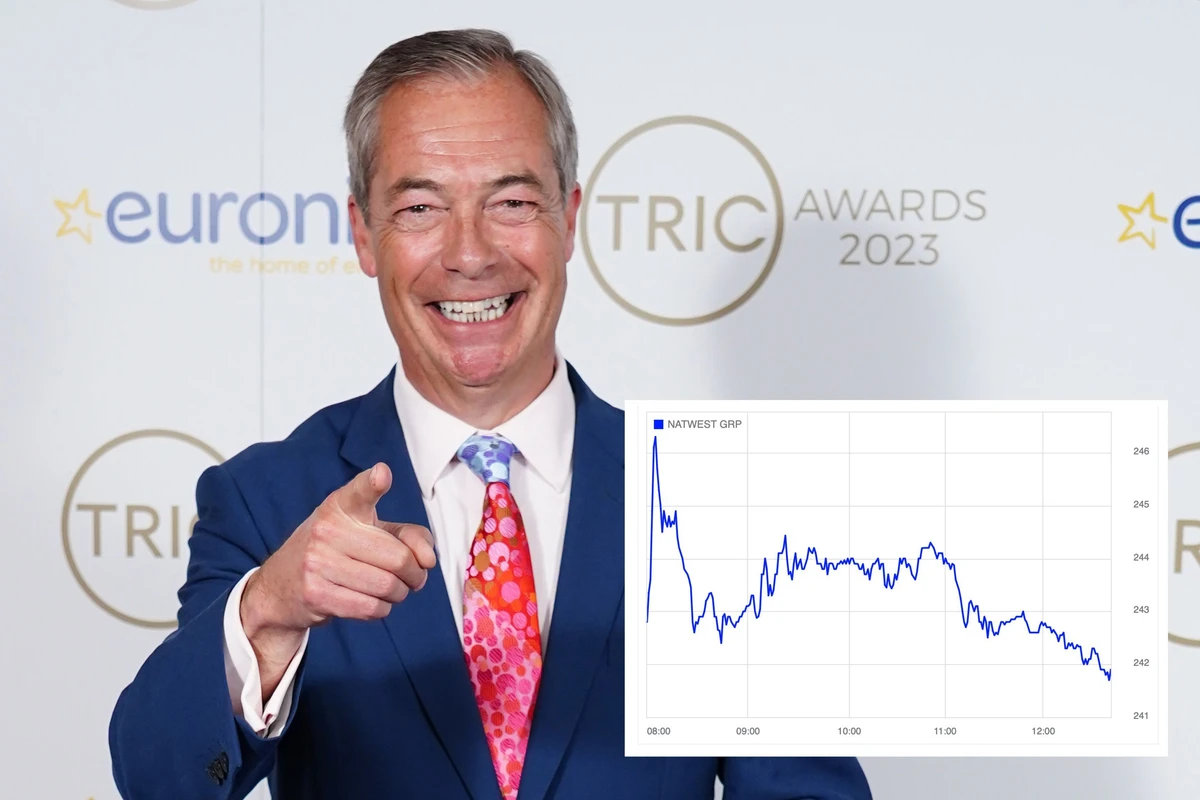

As of October 2023, NatWest’s share price has been fluctuating due to a combination of macroeconomic factors and company-specific developments. Currently trading around £2.20, NatWest’s shares have seen a rise of approximately 5% over the past month. Analysts attribute this uptick in part to the recent announcements regarding increased lending rates and robust financial performance. The bank reported a significant increase in profits in its quarterly earnings, which also helped boost investor confidence.

Key Factors Influencing NatWest’s Market Performance

A crucial factor influencing NatWest’s share price is the Bank of England’s interest rate decisions. With inflation at a 40-year high, the BoE has been under pressure to increase rates, which typically benefits banks like NatWest by widening the interest margin on loans. However, rising rates can also dampen consumer spending and borrowing, creating a delicate balance that investors must evaluate when considering NatWest shares.

Furthermore, the financial sector is navigating through potential regulations post-Brexit, which can impact competitiveness and profitability. The global economic environment, particularly concerns regarding a potential recession, must also be considered. Investors are keenly watching how these factors interplay with NatWest’s operational strategies.

Future Outlook for NatWest Shares

Looking ahead, analysts suggest a cautiously optimistic outlook for NatWest shares. If the UK economy manages to stabilise and inflation is brought under control without steep declines in consumer confidence, NatWest is well-positioned to benefit from its strong capital base and diversified service offerings.

Conclusion

In summary, the NatWest share price reflects the well-being of both the bank and the wider economic context. Investors should continue to monitor upcoming earnings reports, interest rate announcements, and economic indicators that could affect the banking sector. With ongoing developments, NatWest’s share price will remain a pivotal reference point in evaluating the health of the UK banking industry.