Introduction

Mbanq, a leading fintech company, has been at the forefront of digital banking innovation, offering solutions that empower financial institutions to adapt to the digitised financial landscape. With the rise of online banking and the demand for seamless financial services, Mbanq’s relevance has skyrocketed in recent years, helping banks and fintechs enhance customer experiences while reducing operational costs.

What is Mbanq?

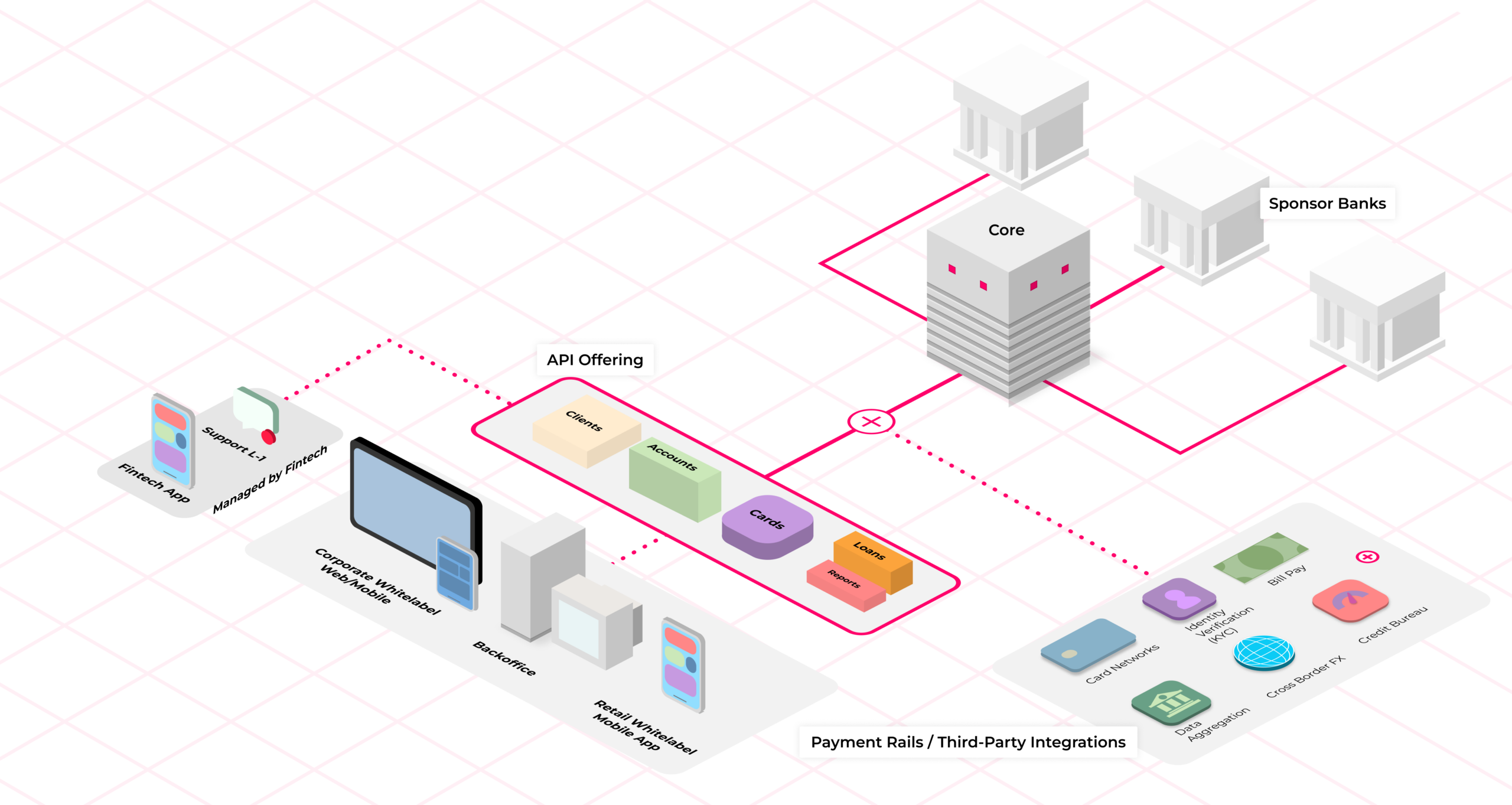

Mbanq provides a Banking-as-a-Service (BaaS) platform that integrates core banking functionalities with cutting-edge technology, allowing clients to launch and manage their own banking products without the extensive overhead associated with traditional banking frameworks. Their services include payment processing, compliance tools, and customer relationship management functionalities, all within a single platform.

Recent Developments

In an exciting recent development, Mbanq announced partnerships with several international banks looking to implement their BaaS solutions. This includes collaborations with institutions in Europe and Asia, underscoring the platform’s versatility and global reach. Mbanq has also invested in artificial intelligence (AI) to enhance its offerings, enabling real-time data analytics and improved fraud detection mechanisms.

Market Impact

The implications of Mbanq’s innovations extend beyond banking institutions. By facilitating digital transformation, Mbanq is contributing to the overall enhancement of financial services, potentially reaching underserved markets that lack access to traditional banking. Its solutions support both established banks looking to modernise and new entrants aiming to disrupt the market.

Conclusion

As digital banking continues to evolve, Mbanq’s solutions will likely play a crucial role in shaping the future of the financial industry. With ongoing investments in technology and strategic partnerships, Mbanq positions itself as a pivotal player in making banking services more accessible and efficient. For institutions aiming to stay competitive in a rapidly changing market, integrating Mbanq’s services could prove to be invaluable.