The Rise of Cryptocurrency Trading

In recent years, cryptocurrency trading has gained significant traction, transforming from a niche market into a mainstream financial activity. With Bitcoin leading the charge, numerous altcoins have emerged, offering diversified investment opportunities. As of 2023, the total cryptocurrency market capitalization exceeded $1 trillion, marking a pivotal moment for traders and investors alike.

Current Trends in Cryptocurrency Trading

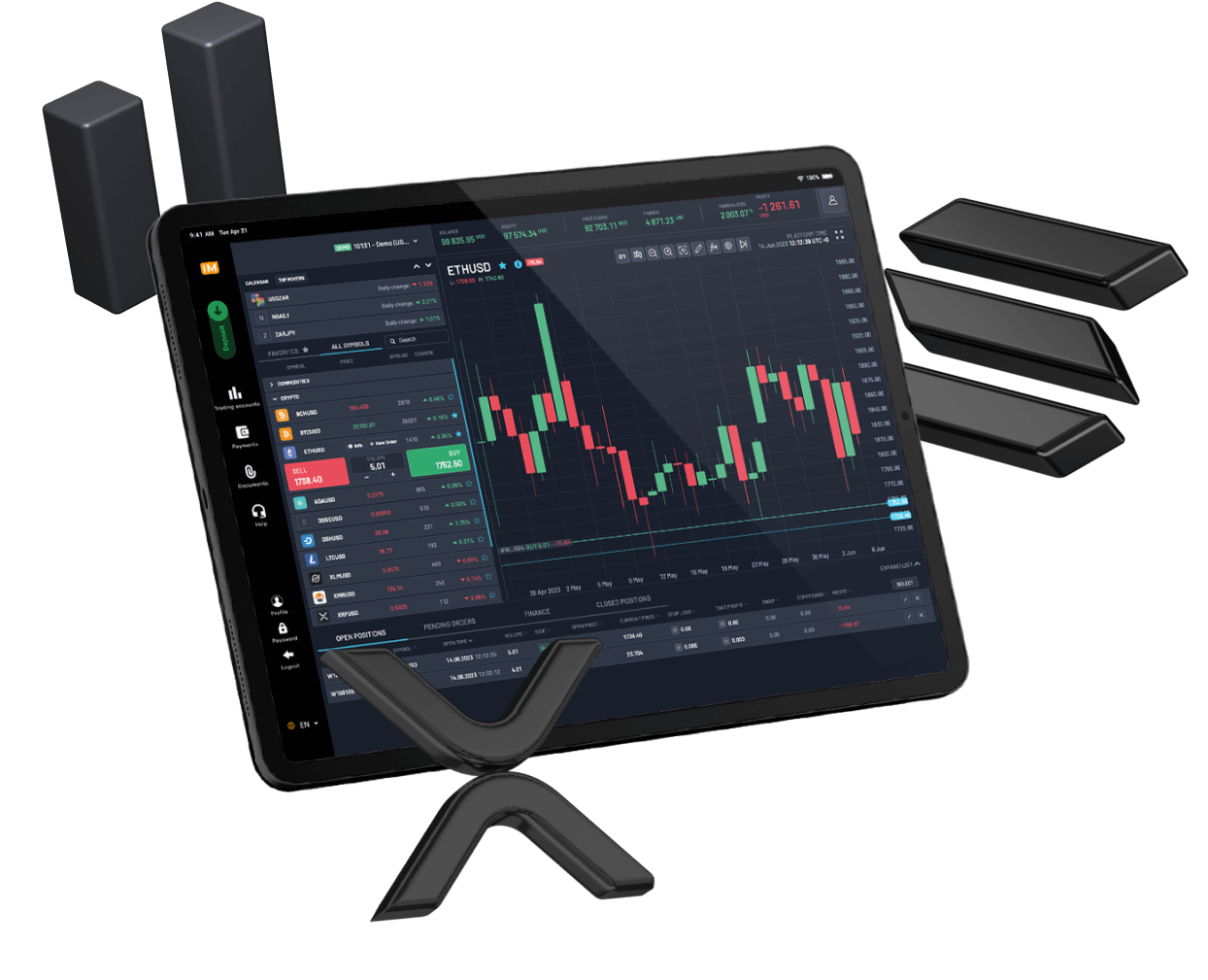

The current landscape of cryptocurrency trading is marked by volatility, innovation, and regulatory scrutiny. Traders are now leveraging advanced trading algorithms and artificial intelligence to refine their strategies. Additionally, the emergence of decentralized finance (DeFi) platforms allows traders to engage in lending, borrowing, and earning yields, further diversifying their portfolios.

Furthermore, notable investments from institutional players, such as hedge funds and publicly traded companies, have bolstered confidence in the market. As of October 2023, a significant increase in retail participation has been witnessed, with millions of new traders joining platforms like Binance, Coinbase, and Kraken.

Risks and Challenges

While the potential for high returns in cryptocurrency trading is appealing, it comes with its share of risks. Market volatility remains a core concern, with prices capable of swinging dramatically within short periods. Additionally, the absence of comprehensive regulations can expose traders to fraudulent schemes and security breaches.

Investors must also consider the psychological aspects of trading, such as fear and greed, which can lead to impulsive decisions. It is crucial for traders to educate themselves about market trends, conduct thorough research, and apply risk management strategies effectively.

The Future of Cryptocurrency Trading

Looking ahead, the future of cryptocurrency trading will likely be shaped by technological advancements and regulatory developments. With the increasing adoption of blockchain technology across various sectors, traditional financial institutions are exploring crypto integration, suggesting a shift towards a more regulated trading environment.

Moreover, as more individuals become knowledgeable about cryptocurrency, the demand for trading tools and educational resources will rise, promoting a more informed trading community. As such, understanding the landscape of cryptocurrency trading will be vital for both new and seasoned traders seeking to navigate this dynamic market.

Conclusion

The world of cryptocurrency trading offers both opportunities and challenges. As the market evolves, investors must stay informed and adaptable. By employing sound trading strategies and being aware of market trends, individuals can enhance their chances of success in this exciting and rapidly changing environment.